Adding a new founder to an existing startup is a common situation that many startups face, and it brings up the critical question: “How much equity should a new founder get?” This is something that I am asked very often. This decision involves various factors, including the new founder’s role, the startup’s stage, and market standards. In the post below I offer some points which will help you make this decision.

Skipping to the end – the bottom line!

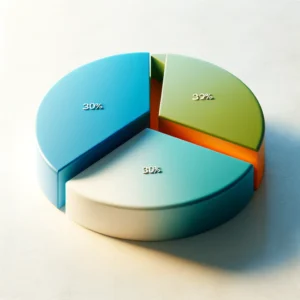

There isn’t a magical number/percentage of equity to offer new founders, because it depends on all of the below factors, including how many founders you already have and what the new founder brings to the table. If you really need to force a number, it could be anywhere from 5% – 30% (with 30% being for relatively early-stage founders, and the new founder either being a valuable CTO, a very experienced and success proven entrepreneur or someone who can definitely bring investments or invest himself).

Do I really need a co-founder?

Before even discussing how much equity a new co-founder should get, make sure that you really need that person as a co-founder, as opposed to them working as a freelancer. The main question to guide you on this is: do I need them for a specific project (even if it’s for a few months) or do I want them with me / they bring value for the entire duration of the startup (which could be 1 year or 8 years)? If you only need them for a specific project, then consider using their services as a freelancer. You can then either pay them, offer them options or shares – but they won’t become a co-founder, and there’s a big difference. One small example: they won’t be part of the decision-making team.

Even you’ve decided to add them as a co-founder, then here’s what you need to consider when discussing equity:

Feelings, emotions, and pride

Wait what? Why is this relevant? Well, there’s a good reason that I started with this because it’s the most important factor. You can consider all the different factors below, and try to persuade someone with logic, but if they feel undervalued or that they aren’t getting a fair percentage, they either won’t join, or they’ll join but eventually end up being disgruntled. This also applies to you, the existing founder. If you feel that you’ve given too much, you too will be disgruntled. So try understand both your own feelings of pride and theirs when discussing the percentages.

Contribution to the Startup

When determining how much equity should a new founder get, one of the main considerations is their contribution to the startup. This includes the skills, experience, and network they bring to the table. A founder with a proven track record or unique expertise may warrant a higher equity stake compared to someone who is just starting their entrepreneurial journey.

Stage of the Startup

The stage at which the new founder joins also plays a significant role. In a pre-seed startup, the risk is higher, and therefore, equity stakes tend to be larger to compensate for this risk. Conversely, in a later-stage startup, the business might be more stable and less risky, so the equity offered might be lower. Additionally, if the original founders have already done most of the ‘heavy lifting’ and made serious advances, then this would affect the amount of equity that the new founder receives. After all, he or she is joining after much of the work has already been done.

Existing Equity Structure

The current equity distribution among existing founders and investors must be considered. Allocating equity to a new founder will dilute the existing shares, so it’s crucial to strike a balance that maintains the motivation of the original founders while being fair to the new founder.

Market Standards and Typical Ranges

Understanding market standards helps in making an informed decision about how much equity should a new founder get. Typically, new founders joining at an early stage might receive anywhere from 10% to 30% equity. For later-stage startups, this range could be significantly lower, around 5% to 10%. According to a survey by Founder Institute, these ranges are common, but the specifics can vary based on individual contributions and negotiations.

Vesting Schedules and Cliffs

Explanation of Vesting Schedules and Cliffs

A vesting schedule is a mechanism that allows founders to earn their equity over time. In the past, founders used to agree on the equity split (say 30%, 30% and 40%) and the founders would get that equity from day 1. Then, if a founder left, even after say 2 months, they would leave with this huge amount of equity which would leave the company crippled. That’s why they created the vesting method which is designed to incentivize long-term commitment to the startup. The way that vesting works is that founder A will be entitled to his 30%, but he will only get it over a certain period of time. Typical vesting period are between 3 – 4 years (with the shares being ‘released’ every quarter of a year / 3 months) + with a one-year cliff (sometimes less). The cliff means that if the founder leaves before the one year period ends, then they receive no equity at all. More insights on structuring equity and vesting (Founder Institute’s guidelines).

Alternative/Additional Incentives Beyond Equity

While equity is a primary incentive, startups can also offer other forms of compensation to attract new founders:

Performance Bonuses

Performance-based bonuses tied to specific milestones can motivate new founders to achieve key business goals. These bonuses can be in the form of cash payments or additional equity. It’s important to note that if you aren’t yet making money, offering cash payments can be risky, so always condition the bonus on the company’s cash flow. Regarding additional equity, this is a decent option, but note that milestones aren’t as easy to anticipate (and achieve) as you think. There are often delays and changes (many a time not at the fault of the new founder).

Future Salary Promises

Startups can promise future salaries once the company reaches certain financial milestones. This can be an attractive proposition for new founders who believe in the startup’s potential but need assurance of future financial stability.

Options

Stock options can be offered as an alternative to direct equity. Options give the founder the right to buy shares at a future date at a predetermined price (usually the price is either symbolic or at a discount to the market value of the shares). This can be an effective way to align the founder’s interests with the company’s growth.

Legal and Financial Considerations

Legal Implications

I work with hundreds of startups, some with decent budgets, others with much smaller budgets. Some agreements can be delayed, sometimes templates can be used (just to start with), but for founder’s agreements and investment agreements ALWAYS use a lawyer.

Tax Considerations

Equity compensation has tax implications that both the company and the founder need to consider. For instance, the issuance of equity might trigger tax obligations (usually on the new founder) depending on the jurisdiction. Founders should consult with a tax advisor to understand the implications fully.

– – – – – – – –

Conclusions and a word of advice

Determining how much equity should a new founder get involves careful consideration of various factors, including their contributions, the startup’s stage, market standards, how many founder’s exist, the existing equity split and of course emotions and feelings of pride/value. By implementing a well-structured vesting schedule and exploring alternative incentives, startups can attract and retain valuable founders while aligning everyone’s interests towards long-term success.

Professional negotiating tip: different cultures negotiate differently. In one country if someone states a price, that’s the final price. In another, it’s only the starting price which can then change by 10%-30%. Either way, when negotiating, people always expect some ‘haggle room’. Therefore, assuming you want to offer someone 20%, you should start by offering 10% or 15% (depending on the culture). They will usually give you a counter offer closer to 20%. Say you need to think about it and wait a day or two, only then agree. Why? It’s called the “Contrast Effect”. This is when someone feels happier about getting something after he or she initially thought that they couldn’t get it or had to work to gain it. If you just agree immediately, they will feel disappointed, because they will think that they could have gotten more. Also, if you start at 20%, and they then ask for more and you say “no”, they will think that you are not flexible or don’t value them.