Startup founders know that good advice can significantly increase the chances of success of their startup, and good advice comes from good advisors. Advisors can help you find design partners, get pilots, help create go to market strategies and prevent you from making a costly mistake. But if you don’t want the relationship to backfire and harm the startup, you must have a proper startup advisor agreement.

Below I’ll explain why it’s important, break down the various sections, and talk about how much equity a startup advisor should get.

What is a Startup Advisor Agreement and why is it important?

A startup advisor agreement is a legal contract between a startup and an advisor outlining the main terms of the relationship. It defines the advisor’s responsibilities, compensation (often in equity), intellectual property (“IP”) ownership, non-compete and many other important aspects. By defining this, it creates clarity of expectations, protection of the founder’s equity and IP, and overall security.

Without a written agreement, misunderstandings about any of the above may arise. For example, an advisor may assume they deserve more equity or influence than the founder originally intended, or worse: that the advisors’ contributions (IP) belong to him.

When Would You Need a Startup Advisor Agreement?

You might be tempted to keep things informal or ‘light’ in the early days, but if you want to protect your IP, your confidential information and other important aspects of the business, you should get an agreement in place as soon as you engage an advisor.

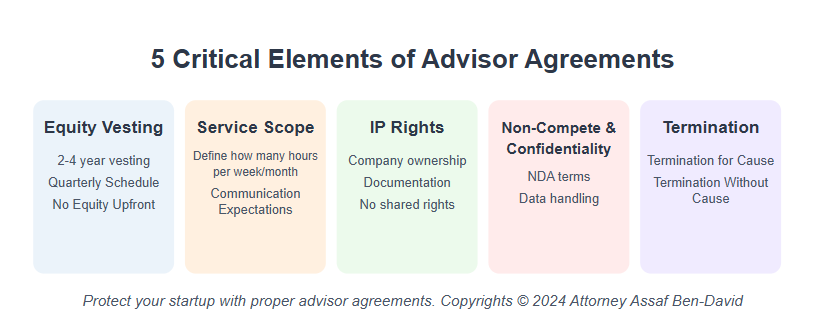

Below are the main sections that must appear in the agreement. There are more sections, but these are the ‘must haves’:

Defining the Services that the Advisor Will Provide

In this section, you need to clearly outline what the advisor is expected to do. Will they provide guidance on fundraising? Help with product development? Or help with the go-to-market plan? Defining the scope avoids confusion and ensures the advisor delivers value in areas that matter.

What to avoid: Vague or overly broad service descriptions. If the advisor’s role isn’t specific, expectations can become misaligned. This could lead to dissatisfaction or claims for more compensation.

Time Commitment and Availability

Clearly define how much time the advisor will be able to dedicate. Is it a few hours per month based on his/her availability or do you need them to commit to regular weekly meetings at specific times? Do you need them to come to certain types of meetings with you? Defining time commitments helps prevent misaligned expectations and helps clarify the reason for termination if they do not fulfill their obligations.

What to avoid: Advisors often have other commitments. If the agreement is too vague, they might not prioritize your startup.

Advisor’s Compensation

Clearly define what compensation the advisor will be getting. Usually, early-stage startups can’t afford to pay advisors in cash. Instead, advisors are offered options (to purchase shares/stock) or actual shares/equity in the company (or the future company to be established). Sometimes you can combine a reduced hourly rate with options or shares (obviously giving less options than you would have if you were only giving options).

How Much Equity Should Advisor’s get?

There isn’t only one right/wrong answer because the amount of equity depends on many variables. Nevertheless, the industry range (for early-stage startups) is about:

- 0.25% – 0.5% options/equity for light involvement (a few hours a month) and small-medium value.

- 0.5% – 1.5% options/equity: more hands-on engagement + more value to thr startup.

- 1.5% – 3% options/equity: intensive ongoing involvement with strategic contributions and lots of value.

For advisors who joined after seed stage, or at growth stage, the percentages are lower.

Note 1: 3% is considered fairly high – but again, this depends on lots of different things: how much you need them, how much value they can provide, how well connected they are, how much time they’ll dedicate, how actively involved they will be etc. I for example (yes me), don’t usually join any startup advisory boards for less than 3% (but I admit that I am different and have my own reasons. I am also fully on board when I join).

Note 2: make sure that the agreement states that any and all taxes that apply to the advisor are paid by the advisor.

How Do I Allocate the Options / Shares (Vesting + Cliff)?

The options or shares should never be given immediately or with the signing of the agreement, but rather over time and subject to the vesting schedule and a cliff mechanism. Here’s an explanation of these mechanisms:

Vesting: vesting means that the options or shares are not given immediately but rather over time – usually 18 – 24 months, sometimes longer (should be at least 1 year), with a percentage of the options or shares released (given to the advisor) every quarter. This means that if the advisor is getting 2%, over a 2-year period, then every quarter he/she will get 0.25% (2% divided by 8 quarters).

Cliff: the ‘cliff’ is a minimum period of time during which if the advisor leaves, he or she doesn’t get any compensation (usually referring to options or shares). The cliff is usually 6 months to a year. So, if an advisor has a 8 months cliff period, and they leave or get fired after 7 months, then even though they were supposed some of the options/shares (because at least one quarter has gone by), they won’t get anything.

Note: some advisors might insist that if they get terminated (versus if they themselves quit) they still get some % despite the cliff.

What to avoid: Using vesting is crucial! Without it, an advisor might potentially leave after just 1 month and still get a nice % of shares or options despite not fulfilling their obligations. Granting too much equity without milestones or vesting can dilute your cap table unnecessarily.

Confidentiality, Non-Compete and IP Rights

Confidentiality: Advisors will usually have access to sensitive information about your startup which is why your agreement needs to include Non-Disclosure sections to prevent them from sharing this information with others.

Non-Compete: because the advisor has access to sensitive information and is often also exposed to the sensitive business decisions, you don’t want him or her using this information against you if/when they join a competing company. To prevent this, you need to include non-compete sections, limiting the advisor’s ability to join a competing business while working with you and for a certain period afterwards.

IP ownership: Lastly, and perhaps most importantly, even more than the compensation section, the agreement needs to clearly state that all the existing Intellectual Property (“IP”), AND the IP that the advisor was involved in creating, during the providing of his/her services (whether alone or with the founders), is owned and belonged by the startup (or the company) and NOT the advisor. This aspect is crucial.

Termination Conditions

Advisory relationships don’t always work out, so it’s important that you include clear termination terms to protect both sides. Common clauses include:

Termination “Without Cause”: meaning that either side can end the agreement with 30 days’ notice without having to give a reason.

For Cause: Termination if the advisor breaches (doesn’t do what he/she is supposed to do) one of the sections which are defined as a material section or breaches any other section and doesn’t correct the breach confidentiality or fails to deliver as agreed.

Ok, the Agreement is important. How Do I Draft a Startup Advisor Agreement?

There are a few options. You can purchase a template or use Chat GPT (or any other AI tool) – but that’s not a great idea because it isn’t tailored to your specific needs and the various AI tools don’t know what questions to ask you (nor do you know what to ask it). Alternatively, you could use the FAST Agreement Template (Founder/Advisor Standard Template). It’s a recognized template that offers a straightforward framework for granting advisor equity based on the advisor’s level of involvement. I personally think that it’s not amazing and that ‘regular’ people (not crazy lawyers like me) won’t fully understand what it means (and signing something that you don’t know what it means is bad business).

Bottom line, and not just because I’m a lawyer, the best option is to have a lawyer draft the agreement for you. The startup advisor agreement is not that expensive (compared to the costs of other agreements for startups) and a startup lawyer will help adjust the agreement to your needs and protect your interests.

Feel free to contact us.